The Corporate Sustainability Reporting Directive (CSRD) is a European regulation that mandates publicly listed organizations to report on sustainability themes starting from the fiscal year 2024.

- In 2024, this requirement applies only to publicly listed companies.

- Organizations with 250 employees and either €50 million in revenue or €20 million on the balance sheet must begin reporting from the fiscal year 2025.

- Small and medium-sized enterprises (SMEs) will follow, starting from the fiscal year 2026.

If your organization is not publicly listed but is part of the supply chain of such companies, it is likely that you will be asked to indirectly report on issues such as CO2 emissions from transportation or production.

Therefore, we will attempt to ask specific questions and explore how to develop reports and analyze data, to gain insights into the journey from data to actionable ESG intelligence.

What should we report?

The CSRD directive requires reporting across three dimensions:

- Environment

- Social

- Governance

These are commonly referred to by the acronym ESG.

These dimensions are quite broad, so your organisation needs to consider what they specifically mean for your business activities. This should include not only the direct impact but also the supply chain impact from your suppliers.

Which Standards Should We Use for Reporting?

Given the broad scope of the reporting dimensions, it is crucial to utilize standards that make specific aspects measurable.

For example, units per type of material and the conversion factor for their CO2 emissions need to be defined. What standards are applied to these definitions?

There are various ESG reporting standards and frameworks, necessitating the need for organisations to select which guidelines to follow. This lack of uniformity can make comparing reports between companies in the supply chain challenging.

For companies in Europe, the applicable standards are the European Sustainability Reporting Standards (ESRS).

Therefore, consider the following:

- Do our (non-European) suppliers and customers also adhere to these standards?

- If not, how do we convert their data to match our standard?

- Are we subject to regular external audits of this data?

- Who within our organisation is responsible for the delivery of this data?

- What actions do we take based on the findings from an audit?

How can we access and analyse the data?

Once it is clear where and how data can be collected and stored, both internally and externally, it's crucial to clean and structure this diverse data within a data warehouse.

In this scenario, it is assumed that you either already have a data warehouse or that you will have one developed externally by a specialised business intelligence (BI) partner. This setup will enable you to effectively manage and analyse your data.

We then look at aspects such as:

- What calculations do we use in the data warehouse to ensure this data is accurate and meets ESG standards in our reports?

- Does this data need to be supplemented with information from other systems?

- What tools (e.g., Power BI) are available to run analyses on the data?

- Does this tooling have access to the data in the data warehouse?

- Can standardised ESG reporting be achieved?

- Do the appropriate departments have access to this reporting?

If your organisation uses a Microsoft Dynamics ERP system, it is likely that you have access to Power BI within the Microsoft suite.

This BI tool allows for the analysis of large volumes of data from Dynamics (and other systems) through comprehensive reports and dashboards, tailored to your role within the organisation.

The challenge remains to structure and model this data effectively, then make it available in Power BI, and where necessary, combine it with data from other systems.

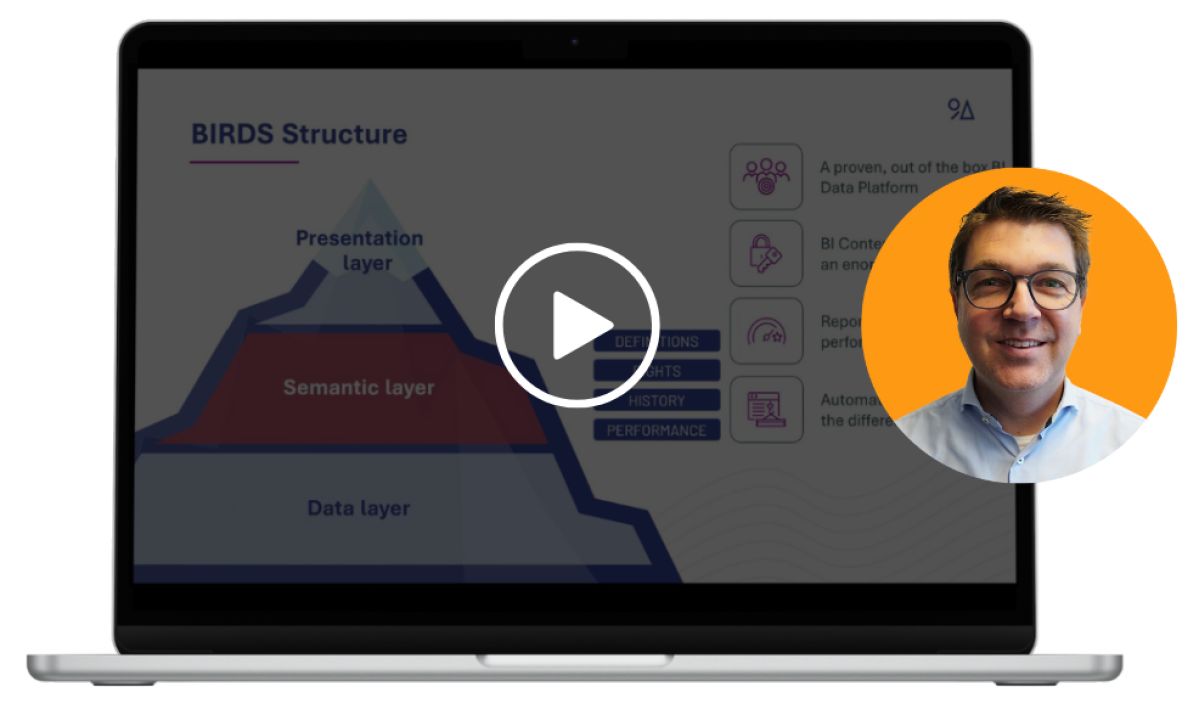

Our solution, BIRDS, provides a standard data warehouse that facilitates this process. Data from Dynamics can be combined with data from other systems, including ESG data, and made accessible in Power BI.

Use these questions as a starting point

Asking the above questions within your organisation forms a solid foundation for developing your ESG reporting strategy.

Even if you are a supplier and are not yet obligated to report on ESG under the CSRD directive, it is wise to proactively align and coordinate with key customers where necessary.

Watch a BIRDS demo video

Interested in seeing how BIRDS generates data insights? Watch our on-demand demo video.

We will demonstrate within a Power BI environment how BIRDS works, including its reports and dashboards.